Cyber | ATC Insurance Solutions

Cyber Insurance

Our cyber policy has been designed to offer Australian SME businesses coverage against both cyber attacks and also to cover their legal, media, data and network security liability and business interruption costs.

Our wording is short and written in a simple language.

Using our unique, online user friendly portal, you can quote, bind and obtain a Certificate of Currency. Access it here: www.brokerportal.atcis.com.au

Resources

Types of coverage

Business Interruption Loss

Remediation Costs

Cyber Liability

PCI Fines

Risk appetite

- Builders, Tradies and Plant Operators

- Sports, Health and Leisure Industry

- Accommodation, Entertainment and Retail

- Financial Services, Real Estate and Education

At ATC, we understand that every risk is different.

Our specialist underwriters have extensive experience in cyber insurance programs throughout Australia.

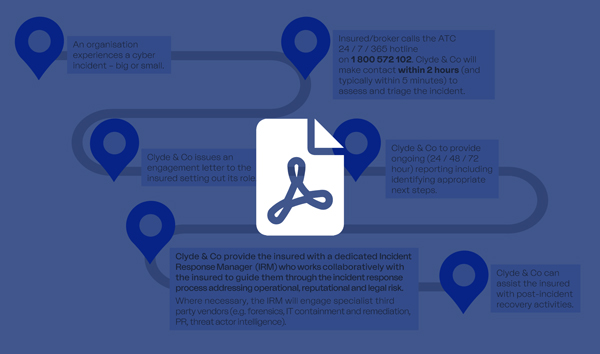

Making a Cyber claim

With the time sensitivity of Cyber-attacks, it is important that our Clients tell us about any real or suspected Cyber claim or incident as soon as possible so that we can get your business back up and running quickly and minimise any potential impacts.

Remember that there is Nil excess on your remediation costs, so asking for help won't cost a thing.

Our Cyber Incident Response is managed locally in Australia by the Atmos First Response Team. Their Incident Response hotline is available 24/7, 365 days a year. We are here to help.

Make a Claim:

Incident Response Hotline

1800 572 102

Our incident response partner

Atmos is Australia and New Zealand’s leading legal and advisory firm specialising in cyber, privacy and digital risk services and have one of the largest dedicated First Response teams in the APAC region.

The Atmos First Response team will work with you navigate and respond to all aspects of a cyber incident, with confidence and unparalleled expertise.

Cyber claims resources

How Cyber Attacks Work

Cyber Incident Responses Explained

Underwriting contact

VIC / SA

Gemma Toma

Underwriter - Cyber

P: 03 9258 1718 M: 0448 547 492

Claims contact